On the “Lists” page you can find the “Your imports” tab on the bottom right. In this tab click on the item “Download the input file template” (which at that point appears underlined) to download a template in Excel to be used to import a list of companies.

Once the Excel file has been downloaded, you need to enter the Fiscal code or VAT number of the companies that make up the customer list of interest in the appropriate cells.

Note: The supported file format is XLSX.

Once the Excel file has been compiled, you have to name it, save it and upload it to the “Your Imports” tab by clicking on “Select a file”.

Before importing the list:

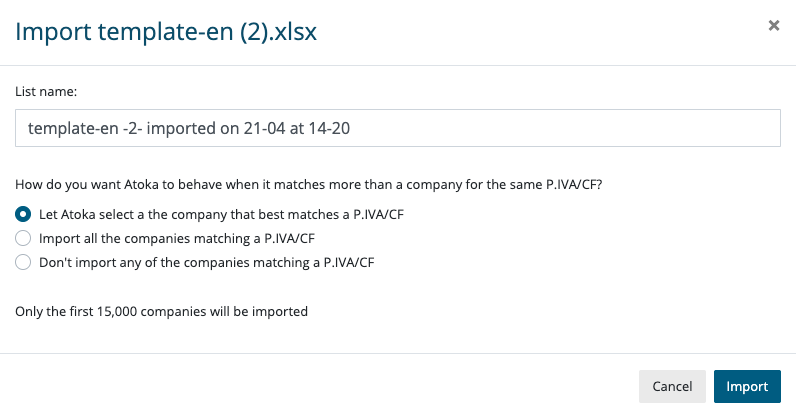

- you have the possibility to rename it in the “List name” box;

- you can choose how Atoka should behave in case there are several companies with the same VAT/FC number. (Note: if you don’t select any of the options, by default Atoka will choose the most relevant of the companies corresponding to the same VAT/FC number.)

Once the file has been selected, click on “Import” to proceed (note: the list can contain a maximum of 15,000 VAT numbers).

In a period of time proportional to the length of the list, the Excel file is loaded into Atoka (the system reports that the upload has been done by displaying, in the row of the file of interest, a check in the “Status” column, and you will also receive an email as soon as the import is ready).

At that point, you can start to work on your list. By downloading the report, you will find 2 different sheets:

- the first sheet with some statistics on the report (for example the number of rows, number of unidentified companies, operative, and non-operative companies, etc.)

- a second sheet with the detailed report and the import results

If there is incorrect or incomplete data in the list (for example a VAT number without a digit), the note “not identified” appears next to the incorrect VAT / CF number.